Bitcoin, Crypto Market Bounce Back After Iran-Israel Clash

[ad_1]

Over the weekend, geopolitical tensions escalated dramatically following an unprecedented conflict between Iran and Israel. The events unfolding on Saturday evening momentarily shook global markets, including the crypto sector. However, there has been a noticeable recovery within the crypto market at the time of reporting.

The swift rebound in crypto values demonstrates the market’s robustness and ability to withstand unexpected global events.

Bitcoin Still Has Strong Support at $60,000 Level

Fears of escalating tensions triggered a sharp downturn for Bitcoin (BTC), the cryptocurrency with the biggest market capitalization, which dipped as low as $60,800 during the conflict. Moreover, BeInCrypto previously reported that approximately $962.40 million was lost during the market’s pullback.

Crypto analyst Ash Crypto explained this downturn as a reaction to the expected consequences of war, i.e., rising commodity prices like oil and gold. Those consequences lead to high inflation, thus making interest rate cuts by central banks less likely.

Read more: Bitcoin Price Prediction 2024/2025/2030

According to Ash Crypto, this situation creates a bearish environment for both stocks and crypto assets.

“Once BTC and alts started crashing, those who had high leverage positions open started getting liquidated, which resulted in more forced selling,” Ash Crypto noted, drawing parallels to similar sell-offs during the onset of Covid-19 in 2020 and the start of the Russia-Ukraine conflict.

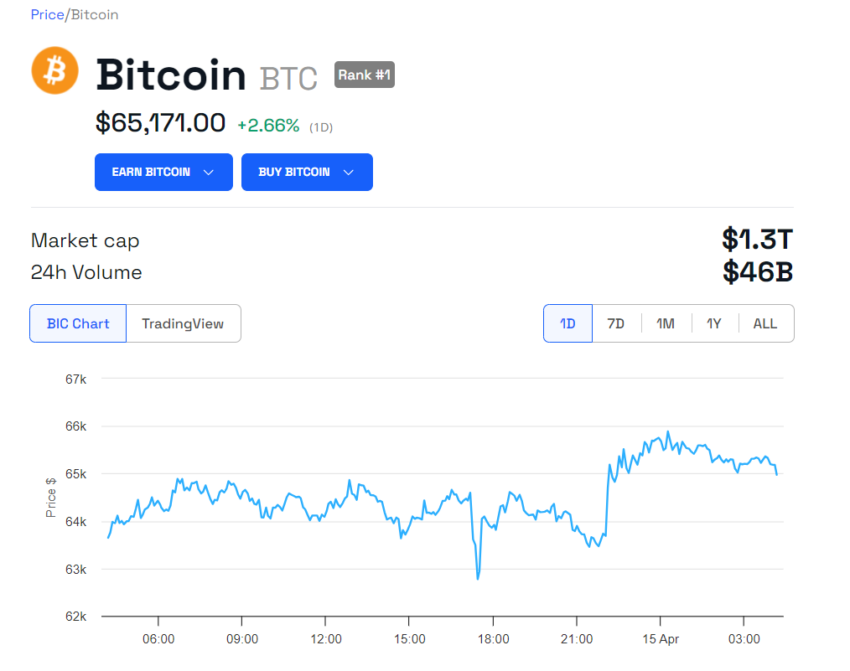

However, Bitcoin and key altcoins have rebounded considerably. Bitcoin is trading at $65,170 at the time of writing, marking a 2.66% gain over the last 24 hours. Ethereum (ETH) and Solana (SOL) have seen even more significant rebounds, up 7% and 12.8% respectively.

Responding to the geopolitical tension’s effect on the crypto market, Mike Novogratz, CEO of Galaxy Digital, predicted a price recovery after an initial sell-off:

“Wars cost $$$…. Praying we don’t get a bigger one, but after the risk flush, BTC will resume its trend higher,” Novogratz wrote on X (formerly Twitter).

Novogratz hoped that cooler heads could prevail and prevent a major regional conflict. This sentiment is crucial for sustained growth in crypto, as markets favor stability.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Despite the volatility, Ash Crypto remains bullish on Bitcoin’s near-term performance.

“Right now, BTC is trading above $63,000 with a strong support at $60,000 level. If the $60,000 level doesn’t hold, there is a strong support level at $56,000 – $58,000 where most new whales (ETF buyers) have bought their BTC,” Ash Crypto outlined.

He further points to history, noting that black swan events often precede parabolic runs within the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link