Find Out Why These Three Altcoins Are Trending

[ad_1]

The crypto market is never short of activity, and currently, Wormhole, Ethena Labs, and Waves are the names taking the spotlight.

Data from Santiment indicates that these altcoins are trending due to unique market activities.

Wormhole’s native token, W, has garnered interest through its Token Generation Event (TGE) and a substantial airdrop exceeding 670 million tokens. In February, Wormhole described the airdrop as a key step toward decentralization.

This event initially boosted W’s value. However, the token fell by 26% from its peak. Concurrently, phishing scams related to the airdrop have surged.

Furthermore, there’s controversy within the community about whether an exploiter who previously stole $320 million worth of Ethereum from Wormhole was wrongly included in the airdrop.

“Wormhole forgot to exclude the exploiter from the airdrop,” DeFi analyst Pland wrote.

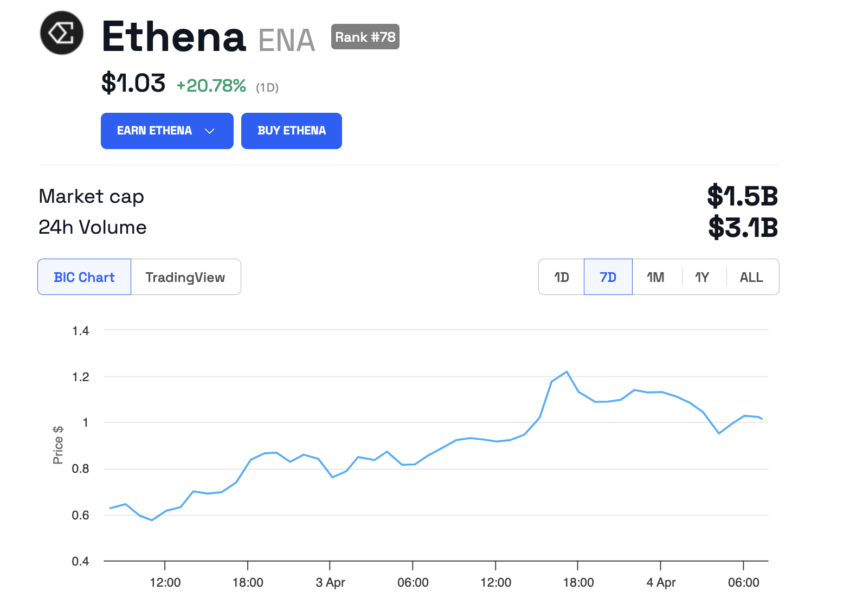

Meanwhile, Ethena’s token ENA is on an upward trajectory, with a more than 200% price increase post-listing. In just 24 hours, it rose by over 20%, now trading at $1.03.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

This rally has attracted scrutiny from Andre Cronje, a DeFi architect. He raised concerns about Ethena’s stablecoin, USDe, suggesting potential risks akin to those in previous market downturns. Cronje’s insights reflect on the volatile nature of DeFi, highlighting the high-risk elements of Ethena’s financial instruments.

“While things are going great now because the market is positive and shorting funding rates are positive because everyone is happy being long, eventually that turns, funding becomes negative, margin and collateral gets liquidated, and you have an unbacked asset,” Cronje said

Additionally, Waves is making headlines with its investment strategy. The protocol proposed using Neutrino Index (XTN) treasury funds to invest in the WavesIndex (WIND) pool, buying tokens with WAVES from Neutrino reserves.

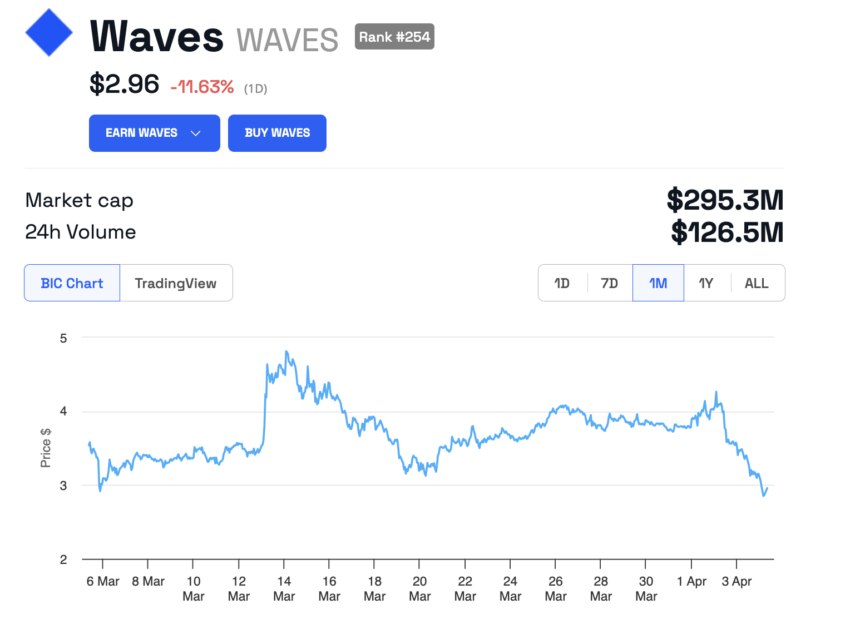

However, this development coincides with a slight downturn in its price, marked by an 11% decrease over the past day. Adding to the volatility, Binance has placed Waves under a monitoring tag, signaling a heightened risk and volatility compared to other tokens.

Read more: Which Are the Best Altcoins To Invest in April 2024?

The tokens that have monitoring tags bear the risk of being delisted by Binance.

“Tokens with the Monitoring Tag exhibit notably higher volatility and risks compared to other listed tokens. These tokens are closely monitored, with regular reviews conducted. Keep in mind that tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance explained.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link