Why Does South Korea FSC Want to Screen New Crypto Execs?

[ad_1]

The South Korean Financial Services Commission (FSC) intends to monitor executive movements within cryptocurrency firms more closely to enhance transparency in the industry.

The regulatory body has issued a call for public input regarding its proposed amendment aimed at revising a rule that currently mandates comprehensive reporting on staff changes within crypto companies.

Crypto Exchanges Under Scrutiny in South Korea

In a recent statement, the South Korean FSC has proposed new regulations that crypto exchanges operating within the country must report any changes to its executive or leadership structure before assigning operational duties to incoming employees:

“If there is a change in the representative or executive of a virtual asset service provider, the provider is obliged to take measures to perform duties only after the change report has been accepted.”

Furthermore, the regulator wants crypto exchanges to report when executives are not performing to standard within the organization.

“Establishment of grounds for discretionary cancellation of reporting in cases significantly disrupting the financial transaction order, such as violations of virtual asset-related laws or inadequate performance of executive duties.”

Read more: 11 Best Altcoin Exchanges for Crypto Trading in January 2024

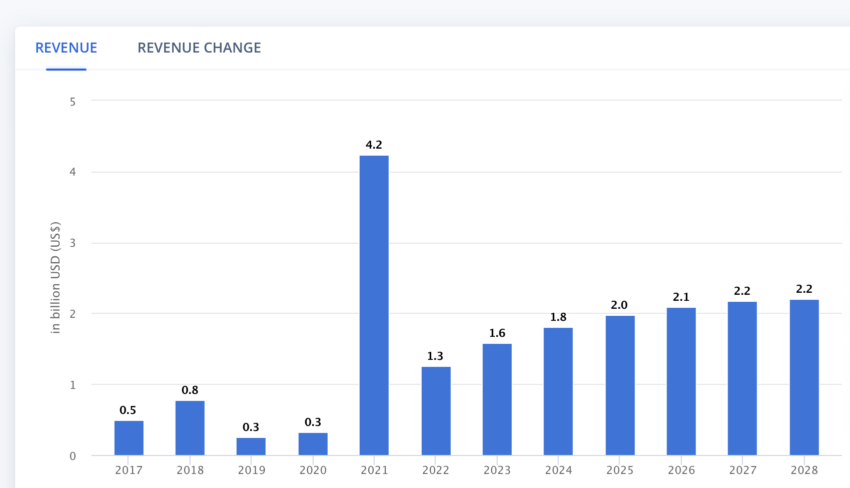

However, South Korea’s annual revenue in the crypto industry is not set to grow exponentially, according to recent data from Statista. Statista forecasts that South Korea will reach $2.2 billion in annual revenue by 2028.

Meanwhile, the United States crypto industry is set to hit $32.9 billion in annual revenue by 2028. Although its population is roughly six times the size of South Korea.

The South Korean FSC has been taking active measures to ensure strong compliance in the crypto industry.

South Korea Efforts to Regulate Crypto Exchanges

Most recently, the Financial Intelligence Unit (FIU) of the Financial Services Commission has been clamping down on crypto mixers. An FIU official recently stated:

“Mixers are an internationally shared issue, so cooperation between countries is necessary.”

BeInCrypto recently highlighted the absence of regulations on crypto mixers in South Korea. This is despite clear evidence of their frequent use for illicit activities.

Read more: Top 12 Crypto Companies to Watch in 2024

Meanwhile, in August 2023, the Korea Federation of Banks proposed that South Korean crypto exchanges with real-name accounts hold a minimum reserve fund.

The new reserve requirement is in an effort to protect users in case of unforeseen issues. This primarily refers to events such as hacks or system failures.

Crypto exchanges now must hold reserves ranging from 3 billion to 20 billion won (approximately $2.2-$15 million).

As part of these guidelines, exchanges must maintain either 30% of their daily average deposits or at least $2 million in reserve, whichever is greater. For instance, larger businesses like Upbit must maintain 30% of their daily deposit requirement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link